Coronavirus could wipe out nearly a fifth of small businesses: NY Fed survey

Most of Main Street was ill-prepared for a massive shock like the new coronavirus, says a new survey from the Federal Reserve Bank of New York. Minority-owned companies in particular could face more difficulty in covering debt payments and accessing credit.

The New York Fed surveyed thousands of small businesses across the U.S. in the second half of last year. The survey, released Tuesday, reported that 17% of firms would have to close if they experienced a two-month loss of revenue.

While the survey was conducted before the coronavirus hit, it highlights the fact that small businesses will have trouble staying afloat amid state orders to close non-essential businesses. Many of those orders were issued last month, and it’s still not clear when they will be lifted.

“Small businesses nationwide now face unprecedented challenges as the country grapples with the significant economic and social effects of the COVID-19 pandemic,” New York Fed assistant vice president Claire Kramer Mills said.

With widespread business closures and millions of Americans losing their jobs, the New York Fed survey highlights the challenges faced by restaurants and shops fighting to survive.

In addition to having to tap into personal funds, business owners reported that their contingency plans would likely involve reducing employee salaries or their own salaries (37% of respondents) or laying employees off entirely (33% of respondents).

About 30% of respondents said they would defer payments or expenses, raising the real-world concern that the coronavirus will force businesses to miss rent or debt payments. The survey added that about half, or 49%, of respondents said they had already faced an increase in rent over the prior 12 months.

The NY Fed says it hopes its research can guide the public policy response, as lawmakers on Capitol Hill work through an extension of the Paycheck Protection Program originally launched with the support of $349 billion in Small Business Administration loans.

Credit, debt problems for minority businesses

The inclination to lay off workers or shut down completely from a 60-day revenue disruption underscores the dire need for small businesses to get funding now. But operating pressures may be heightened among minority-owned businesses.

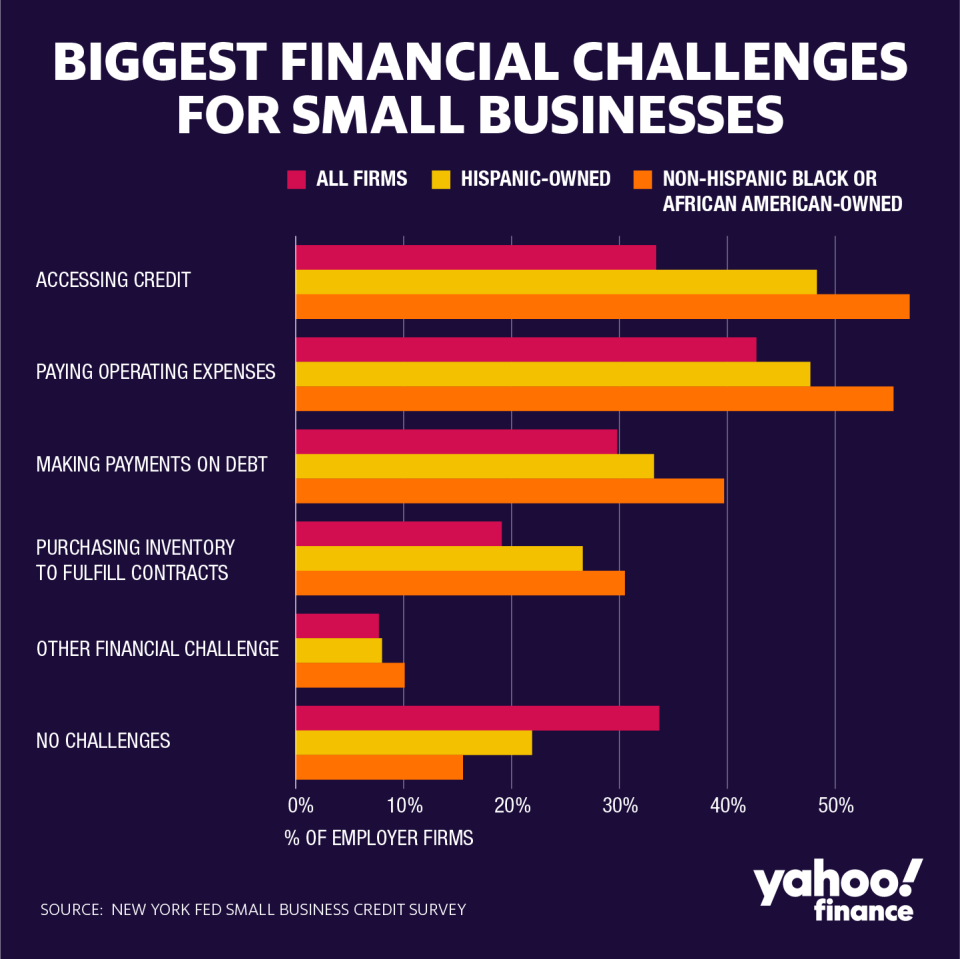

Whereas 33% of all firms reported difficulty in accessing credit, nearly half of Hispanic-owned businesses (48%) and a strong majority of black-owned businesses (57%) listed credit as a financial challenge.

Hispanic- and black-owned businesses also reported greater challenges in meeting their debt obligations compared with the national average. About 30% of all the businesses surveyed cited debt payments as a challenge, compared to 33% of Hispanic businesses and 40% of black businesses.

Because of the challenges with obtaining a traditional bank loan, minority-owned businesses also reported a higher likelihood of turning to non-bank lenders that were more likely to face unfavorable interest rate terms. Over half, 55%, of black-owned businesses said high interest rates posed a challenge when trying to obtain a loan from an online lender.

In the context of the coronavirus response, the data point to an increased urgency to make sure minority-owned businesses can access emergency loans.

The PPP loans have been available through SBA lenders since last Friday, but logistical problems in launching the program raised concerns about how fast businesses can get relief.

The New York Fed survey emphasizes the importance of throwing a lifeline to businesses — and the need for that life line to be provided quickly.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Banks undergoing 'real stress test' as recession fears continue

Federal Reserve to backstop Paycheck Protection Program loans

‘Substantial deterioration’ in consumer expectations: NY Fed survey

SF Fed Chief: Central bank will ‘do whatever it takes’ to support economy

Federal Reserve opens up seventh liquidity facility, to supply US dollars abroad

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo News

Yahoo News