Daimler and Via bring shuttle ride-sharing to London

BI Intelligence

This story was delivered to BI Intelligence Transportation and Logistics Briefing subscribers hours before it appeared on Business Insider. To be the first to know, please click here.

Mercedes-Benz parent company Daimler and US-based ride-hailing firm Via announced that they're bringing ViaVan, their jointly owned shuttle-based ride-sharing service, to London later this year, according to Engadget.

London will be the service's second city after it launched in Amsterdam last month, and although ViaVan will only operate in Central London Zones 1 and 2 initially, the companies eventually plan to cover the entire city. The service allows customers to book rides to specified destinations through a mobile app like most ride-hailing services, but customers will likely always share rides with other users, making it similar to UberPOOL, but based out of vans rather than cars.

ViaVan is part of Daimler's multi-pronged alternative mobility services portfolio. The company, through its Moovel subsidiary, also operates MyTaxi, a traditional ride-hailing service that competes directly with Uber throughout Europe, and has a presence in 70 countries and has 11 million total users.

Additionally, Daimler operates car-sharing service Car2Go, which has 3 million users spread out over 26 cities around the globe. ViaVan is the latest addition to this lineup of mobility services and shows Daimler is looking to maximize its mobility footprint, perhaps to test consumers' appetite for several alternative mobility services. While ViaVan hasn't specified any plans to expand beyond London and Amsterdam, if it chooses to do so, it could gain an advantage over competing services by tapping into Daimler's massive user base for its other mobility offerings.

London represents a massive opportunity for ViaVan, but Daimler and Via will need to contend with an often challenging regulatory environment for mobility services.London boasts a huge mobility services market — Uber counted 3.5 million users and 40,000 drivers in the British capital as of last fall, making it one of the company's most lucrative European cities. ViaVan is touting higher pay than traditional ride-hailing services to try and rapidly attract drivers to grab a chunk of this massive opportunity.

However, London hasn't always been friendly to alternative mobility services, which could present challenges for ViaVan to rapidly scale up across the city. Notably, Transport for London, the city's transportation regulatory body, refused to renew Uber's license to operate in the country last December, though the company continues to operate as it appeals the decision. While ViaVan's CEO Chris Snyder told Business Insider that it's in compliance with all of London's laws and regulations, and it's possible the service's potential to reduce congestion could help it win over regulators, it nonetheless could face some of the same issues that Uber has had to grapple with.

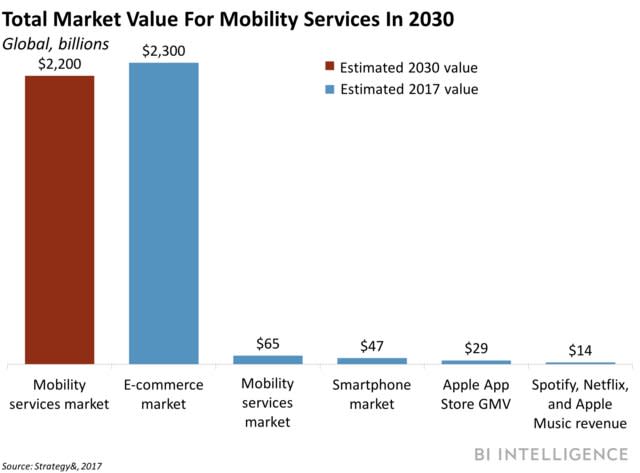

In a new report, Business Insider Intelligence, Business Insider's premium research service, delves into the future of the on-demand mobility space, focusing on how automakers will use fleets of self-driving vehicles to break into an emerging industry that's been dominated thus far by startups like Uber and Lyft. We examine how the advent of autonomous vehicles will reshape urban transportation, and the impact it will have on traditional automakers. We then detail how automakers can leverage their core strengths to create new revenue sources with autonomous mobility services, and explore the key areas they'll need to gain new skills and capabilities in to compete with mobility startups and tech giants that are also eyeing this opportunity.

Here are some of the key takeaways:

The low cost of autonomous taxis will eventually lead car ownership rates among urban consumers to decline sharply, putting automakers’ traditional business models at risk.

Many automakers plan to launch their own autonomous ride-hailing services with the self-driving cars they're developing to replace losses from declining car sales, putting them in direct competition with mobility startups and tech giants looking to launch similar services.

Additionally, automakers plan to maximize utilization of their autonomous on-demand vehicles by performing last-mile deliveries, which will force them to compete with a variety of players in the parcel logistics industry.

Regulatory pressures could also push automakers to consider alternative mobility services besides on-demand taxis, such as autonomous on-demand shuttle or bus services.

Providing these types of services will force automakers to make drastic changes to their organizations to acquire new talent and skills, and not all automakers will succeed at that.

In full, the report:

Forecasts the growth of autonomous on-demand ride-hailing services in the US.

Examines the cost benefits of such services for consumers, and how they will reshape consumers’ transportation habits.

Details the different avenues for automakers to monetize the growth of autonomous ride-hailing.

Provides an overview of the various challenges that all players in the self-driving car space will need to overcome to monetize their investments in these new technologies in the coming years.

Explains the key factors that will be critical for automakers to succeed in this emerging market.

Offers examples of how automakers can differentiate their apps and services from competitors’.

See Also:

Yahoo News

Yahoo News