Fears over consumer borrowing as figures reveal £1.7bn debt binge

Fears of a dangerous new consumer borrowing binge deepened today as official figures showed another £1.7 billion in credit card and personal loans were handed out last month.

The total was higher than the £1.4 billion expected by City analysts and kept the annual rate of growth in consumer credit above the 10 per cent mark.

Growth in credit card borrowing slowed from £0.6 billion to £0.4 billion but growth in other loans and advances, including car finance deals, accelerated from £0.9 billion to £1.3 billion, according to the Bank of England.

Economists said that the squeeze on household budgets could be forcing families to “max out” their cards and other sources of credit just to pay the bills.

Howard Archer, chief economic advisor to forecasters the EY ITEM Club, said: ”This was the 13th successive month of double-digit year-on-year consumer credit growth, and occurred despite weakened retail sales during the month.

“It may be that the heightened squeeze on consumer purchasing power is increasing the need for some consumers to borrow.

“The Bank of England will be far from happy with the May consumer credit data, and it could bolster the case for a near-term interest rate hike to try to curb consumers’ readiness to borrow.

“While any interest rate hike would be small with further increases some way off, even small increases could cause problems for some consumers given high borrowing levels.”

The latest data came two days after the Bank of England ordered banks to build up an extra £11.4 billion buffer against those consumer loans turning sour.

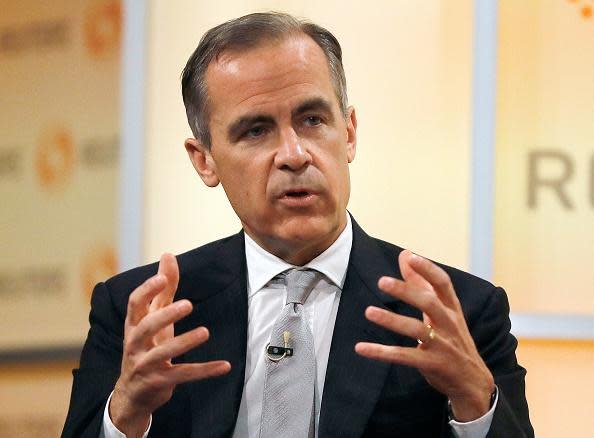

Governor Mark Carney warned that banks are “forgetting the lessons” of the financial crisis by relaxing controls on lending and increasing the risk of another debt crisis.

He added: “Consumer credit has increased rapidly. Lending conditions in the mortgage market are becoming easier. And lenders may be placing undue weight on the recent performance of loans in benign conditions.”

Capital Economics forecaster Ruth Gregory said: “Households remain confident enough to increase borrowing to help smooth consumption, in the face of the squeeze on their real incomes. Of course, this will do nothing to allay policymakers concerns about the recent rapid increases in unsecured lending.”

Today’s figures added to speculation that the Bank of England will raise interest rates soon to rein in lending sending the pound through the $1.30 level for the first time in five weeks.

Meanwhile, the number of mortgages approved for home buyers rose from 65,051 in April to 65,202 in May, also higher than expectations.

Experts said the robust home loans figures were driven by increased levels of remortgaging. Alastair McKee, managing director of independent mortgage broker, One 77 Mortgages, said: ““People are increasingly feeling the financial squeeze and they are also worried that rising inflation could force the Bank of England’s hand on interest rates.

“As a result, locking into a fixed rate of two or even five years is becoming more of a priority for people.

“What people are also increasingly aware of is that they can secure a new mortgage offer up to six months in advance of their current deal ending.

“There’s a whole new level of flexibility in the mortgage market that borrowers are now able to tap into.

“Beyond the increase in remortgage activity, the narrative of strong first time buyer activity and weaker demand from landlords remains much the same.

“It’s a trend that is likely to continue throughout 2017 and perhaps well into next year.”

Yahoo News

Yahoo News