Encompass Health (EHC) Updates 2022 Guidance: Dips 5.4%

Encompass Health Corporation EHC provided a comprehensive picture of its guidance, following which its shares fell 5.4% yesterday (Tuesday Jun 7). Management issued a consolidated guidance for 2022 as well as separate views for EHC’s inpatient rehabilitation business, and its home health and hospice business. EHC is spinning off its home health and hospice business come Jul 1, 2022. The new entity will be named Enhabit.

Let’s delve deeper.

Consolidated Guidance

The outlook for 2022 net operating revenues is within $5,330-$5,420 million, down from previous expectation of $5,380-$5,500 million. The midpoint of the new guidance is higher than $5,121.6 million recorded in 2021. Management lowered adjusted EBITDA guidance from $1,015-$1,065 million to $1,005-$1,045 million. The midpoint is lower than the 2021 level of $1,028 million.

Adjusted operating earnings per share are now expected within $3.76-$4.05, down from the previous guidance of $3.83-$4.19. Last year, Encompass Health reported adjusted earnings per share of $4.23. The declining profit level might have spooked investors, resulting in the 5.4% decline in share value. Moreover, EHC expects to continue its cash dividend payout but the amount might decrease to reflect the splitting of the home health and hospice business. Enhabit is not expected to pay cash dividends yet.

Encompass Health

Following the separation, Encompass Health will have a single reportable segment, which is the inpatient rehabilitation. Net operating revenues for 2022 are expected within $4,250-$4,300 million. This unit reported net operating revenues of $4,015 million in 2021.

Adjusted EBITDA is likely to lie in the $820-$840 million bracket in 2022, indicating a decline from $956.8 million a year ago. Adjusted operating earnings per share are now expected within $2.77-$2.91. Encompass Health expects to make 100-150 bed additions and 6-10 de novos per annum in the 2022-2026 period.

Enhabit

Enhabit will have two reportable segments, namely home health and hospice. Management expects net service revenues of Enhabit within $1,080-$1,120 million for 2022. Adjusted EBITDA will likely be in the range of $165-$185 million, down from $211.5 million in 2021. Per management, the home health division is projected to witness a 4-5% increase in cost per visit. The hospice unit is expected to suffer stuffing constraints and see a 3-4% rise in cost per patient day. Adjusted earnings per share for 2022 are expected within $1.64-$2.01.

During the 2022-2026 period, EHC expects the home health unit to witness around 10% CAGR in admissions, while the same in hospice is expected within 10-15%. Moreover, Enhabit is likely to make acquisitions worth of $50-$100 million per annum within the aforementioned period.

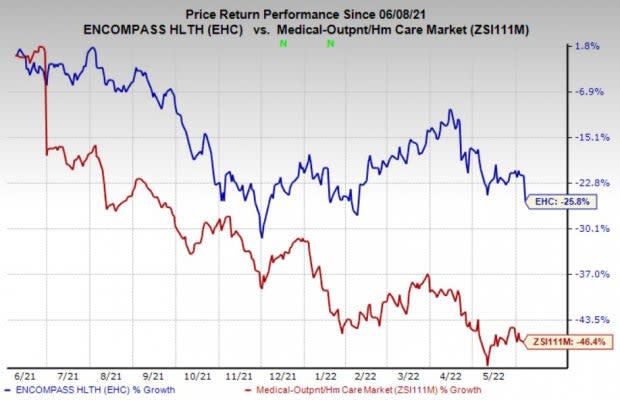

1-Year Price Performance

Shares of Encompass Health have declined 25.8% in the past year compared with the 46.4% fall of the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank and Key Picks

Encompass Health currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the medical space are Select Medical Holdings Corporation SEM, Omega Therapeutics, Inc. OMGA and Progyny, Inc. PGNY, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Select Medical’s earnings is currently pegged at $2.19 per share. SEM has witnessed one upward estimate revision in the past 60 days against none in the opposite direction.

Select Medical’s earnings beat estimates in each of the last four quarters, the average being 42%.

The Zacks Consensus Estimate for Omega Therapeutics’ earnings indicates a 28.9% increase from the prior-year reported number. OMGA has witnessed three upward estimate revisions and no downward movement in the past 60 days.

Omega Therapeutics’ earnings beat estimates twice in the last four quarters and missed the mark on the other two occasions.

The consensus estimate for Progyny’s 2022 bottom line has improved 4.5 times in the past 60 days. PGNY has witnessed three upward estimate revisions during this time frame against none in the opposite direction.

Progyny’s earnings beat estimates in each of the last four quarters, the average being 169.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

Progyny, Inc. (PGNY) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News