Fixed-rate mortgage or tracker? How to tackle high interest rates

With the mortgage market still reeling from the chaos seen just a couple of weeks ago, anyone whose mortgage deal is coming to an end may well be at a loss of what to do for the best. Fixing now is expensive, as average two-year fixed rates are now at 6.79pc – a 15-year high, according to data from Moneyfacts – which overtakes the level last seen following Liz Truss’s mini-Budget last year.

However, opting for a tracker might mean you come unstuck if the Bank Rate continues to rise steeply in a bid to tackle stubborn inflation. The Bank of England increased interest rates by 0.25 percentage points to 5.25pc in August.

CPI inflation fell to 6.8pc in July, down from 7.9pc in June. So-called core inflation stuck at 6.9pc, which strips out prices for energy, food, alcohol and tobacco. While inflation is going in the right direction, the rate is still far higher than the Bank’s target of 2pc.

Many households have been biding their time on tracker rates, pegged to central interest rates, as fixed-rate deals soared in price at the end of last year.

Trackers were priced significantly lower than the average fixed-rate mortgage during the economic fallout which followed the mini-Budget last year.

When mortgage rates peaked in mid-November the average two-year fix was priced at 6.65pc, while the average two-year tracker rate was 3.77pc – an interest saving of £360 each month on a £150,000 loan.

Homeowners piled in and there are now thought to be as many as 1.6 million households on variable rates.

Is it a bad time to fix?

There are signs that rates for fixed-rate deals are starting to come down, as several big banks have cut their rates. However, fixes are still expensive. The average two-year fixed rate is now around 6.79pc, according to Moneyfacts, while the typical two-year tracker is 6.22pc. A borrower with a £200,000 loan could save £71 a month in interest by opting for the tracker.

Adrian Anderson, of broker Anderson Harris, said the recent spike in fixed rates and hints from the Bank’s Monetary Policy Committee that Bank Rate may not increase as high as anticipated has pushed some to consider trackers with no penalties, which means they can come out of the deal whenever they want to without paying early repayment charges.

He said: “A tracker mortgage is deemed higher risk than a fixed rate product. Those considering a tracker are people who still want flexibility – maybe they have other assets they can use to overpay the mortgage if they want to. Fixed rates are more restrictive in that you can usually only overpay 10pc of the balance a year.”

People who have a more comfortable financial position tend to be more likely to choose tracker rates, while others who are worried about how they would cope with a potential spike in their mortgage costs are opting for five-year fixes, he said.

Some are also concerned about falling property prices in the next two years and how they could impact the value of their equity – the more equity they have, the lower the rate they are typically eligible for.

There is no ceiling on how high repayments could rise, and their volatile nature means tracker mortgages are not appropriate for households that prize certainty over savings.

Now read: As interest rates rise, use our mortgage calculator to see how much more you will pay

Where can I find the best deal?

The average two-year fixed rate has risen to 6.79pc, while the typical five-year rate is now at 6.33pc, according to Moneyfacts.

The best two-year fixed rate mortgage, for a 40pc deposit, is 5.66pc with MPowered Mortgages with a £2,495 fee. The best five-year fix is 5.23pc, with Virgin Money, with a £1,295 fee. By comparison, the cheapest two-year tracker mortgage is 0.15 percentage points above the Bank Rate.

It is important to remember that the lowest interest rates do not necessarily equate to the best deal. High fees can sometimes outweigh marginal savings on similarly priced interest rates.

Now read: Everything you need to know about remortgaging in 2023

How long should I fix for?

The cost of borrowing this year will remain inflated, serving as a shock for households coming off rates fixed two or five years ago. More than 1.4 million borrowers will pay higher rates this year as their fixed deal comes to an end, according to figures published by the Office for National Statistics.

Thanks to June’s more promising inflation figures, the Bank Rate is now forecast to peak around 5.7pc next year. Previously, experts feared it may rise to well over 6pc.

David Hollingworth of L&C Mortgages said whether to ditch a tracker for a fixed rate now was the “£1m question” – and it’s not getting any easier.

He explained that while fixed rates are starting to come back down a little, that doesn’t rule out the potential for more increases to Bank Rate, which would push tracker rates higher.

“The Bank has suggested that rates could be higher for longer, so those that are prepared to play the long game in the hope of base rate falling back may have to be patient,” said Mr Hollingworth.

“Of course, these forecasts can still shift rapidly, so borrowers should focus on how well they feel they can cope with the fluctuation of a tracker rate, compared to security that a fixed rate can bring.”

Now read: ‘My mortgage has gone up £500 – and now I’m stuck with it for five years’

Should I lock in a new deal early?

If you need to remortgage in the next three to six months, it may be possible to secure a new mortgage deal early, which will still be valid by the time you need to actually make the switch.

Locking in a new deal now – whether it’s for a tracker or a fixed-rate – may shield you from further rises to come. After all, there are several more Bank Rate decisions to come before the end of the year, by which time the mortgage market could look very different.

Having a new mortgage lined up ahead of time will also save you from spending any time on your lender’s standard variable rate (SVR), which will almost certainly charge far more interest than any fixed or tracker options.

Mr Hollingworth said: “Once an application is made a deal will be secured and that could be done up to six months before the end of the current deal.

“That will mean that borrowers are protected against any further rises in fixed rates, but they can still change to a new deal if rates improve in the meantime.”

It’s a good idea to speak to a mortgage broker to assess your options before making any firm decisions.

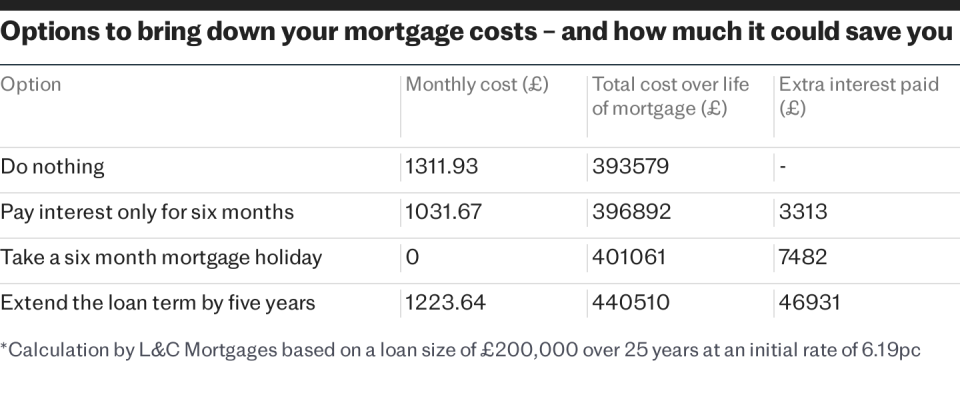

If you’re concerned about whether your budget will be able to stretch to higher mortgage costs, talk to your lender. Sam Richardson, deputy editor of Which? Money, said: “With recent Which? research finding that some 700,000 people missed a rent or mortgage payment in April, and interest rates at the highest levels since 2008, many mortgage owners coming to the end of their term will understandably be concerned about their situation.

“Mortgage lenders are obliged to offer support to their customers, so those struggling to meet mortgage payments should speak to their lender about what help is available. Doing so will not affect your credit rating. Further support may come in the form of temporary break from payments, interest-only repayments or extending the term of the mortgage.”

Now read: How to stay on top of rising mortgage repayments – and keep your home

This article was first published on February 2, 2023, and is kept updated with the latest information.

Yahoo News

Yahoo News