Hostile Migration Policy Threatens UK Chip Industry, Bosses Say

(Bloomberg) -- British chipmakers warn that a UK crackdown on immigration is hobbling the sector’s ability to compete globally because of increased barriers to hiring foreign talent. Moreover, they expect those roadblocks to persist whoever wins next week’s general election.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

Nvidia Rout Takes Breather as Traders Scour Charts for Support

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

Israel Court Calls Ultra-Orthodox Men Into Army as Crisis Brews

Both prime minister Rishi Sunak’s Conservatives and Keir Starmer’s poll-leading Labour Party have pledged to slash net migration should they win power on July 4. That stance frustrates semiconductor company bosses who already complain about Home Office hostility as they grapple with a skills shortage that can’t quickly be plugged domestically.

“Talent is the bottleneck for everything that we do,” said Rodney Pelzel, chief technology officer of IQE, which makes wafers used in chips for the wireless industry, and whose clients include Apple Inc. “Finding the skillset so far hasn’t limited us, but I could see that at a future point it would.”

With immigration looming large over the election campaign — it’s the third most important issue for voters after the economy and health care according to YouGov — politicians’ pledges to bring numbers down undermines national efforts to strengthen the domestic semiconductor industry.

The Tory government last year published a strategy for the sector identifying chips as “one of the five technologies of tomorrow” that’s “vital” to making Britain a technology superpower. The need for more domestic production has been brought into focus in recent years after supply chains broke down during Covid-19 lockdowns and rising geopolitical tensions highlighted the dangers of heavy reliance on overseas factories. Taiwan is the source of about 90% of the manufacturing capacity for leading-edge chips.

The government designates semiconductors a technology that’s critical to the economy due to their use in electronic devices from smartphones to cars and missiles. But some 80% of UK chip companies — valued altogether at $13 billion in 2023 according to Expert Market Research estimates — have vacancies, the UK Electronics Skills Foundation estimates.

The government’s strategy for the industry announced last year, to “improve the ability of the UK ecosystem to attract the skilled talent it needs” included just £1 billion toward boosting the industry. It’s a paltry amount compared to subsidy programs in the US and EU worth tens of billions of dollars, with the UK planning to focus on research and design rather than manufacturing.

As the global race for talented tech workers heats up, UK immigration reforms announced in December make the country a less attractive destination, compounding a shortage of tech workers that started with the UK’s decision to leave the European Union.

The more recent reforms included raising the minimum salaries of workers brought in on skilled worker visas, and making it harder for immigrants to bring in family members. The government also pledged to review visas for overseas graduates of UK universities. In April, electronic engineers, crucial to chip design and manufacturing, were removed from the UK’s shortage occupation list, which affords sought-after foreign professionals an easier and cheaper entry route.

“We had real difficulty in the deep tech business, real difficulty hiring people in England,” Colin Humphreys, co-founder of Paragraf, which develops chip technologies using the cutting-edge material graphene, said on a panel at the Founders Forum in Oxford this month. “We want a government which really pushes up the investment in science and technology and industry, and, also, when it makes decisions, they ask what effect will these decisions have on industry. That is not done at the moment.”

Humphreys said Paragraf — which has had to pay more to hire from the US and has been disappointed by the obstacles and lack of government support for its expansion — is considering moving its operations there because “of the ease of getting things done in America. It’s so difficult in England.”

Companies complain the visa process is too bureaucratic and takes upwards of 18 weeks, compared to six in France. Paragraf’s human resources manager, Helen Dighton, said some candidates withdraw applications when they realize the time and cost required to secure a visa, as well as the £1,035 ($1,308) surcharge migrants must pay to access the National Health Service.

“There’s just loads and loads of red tape,” said Mark Lippett, CEO of Bristol-based XMOS, which makes chips used in audio equipment.

Neil Dickins, founder of semiconductor recruiter IC Resources, said hiring one international employee would cost £9,000 or more in license and legal fees — which he called “a tax on companies trying to compete for global talent.” Moreover, that comes on top of the annual immigration skills charge, which depends on the company’s size but on average costs about £600, he said. A similar process would cost one tenth of the price in Germany.

Another chief executive officer of a British chip designer — who spoke on condition of anonymity while discussing commercial matters — described a global war for talent in which bureaucracy and prohibitively restrictive immigration rules could lead to devastating losses of potential employees to foreign competitors.

The executive said the Home Office had been hostile when they were trying to secure foreign recruits in the wake of Brexit, and that after moving to a new company, they’d opened a new office on the continent where it was easier to employ foreign labor. Half of the operation now runs from overseas — at a considerable loss to the UK in income tax, they noted.

The Home Office said its sponsorship system is designed to be easy to use and they have introduced measures to streamline processes for companies seeking to bring in skilled workers.

The problem for company bosses is that both the Tories and their likely Labour successors — Starmer’s party enjoys a polling lead over the governing one of more than 20 points, with less than two weeks to go — are talking tough on immigration.

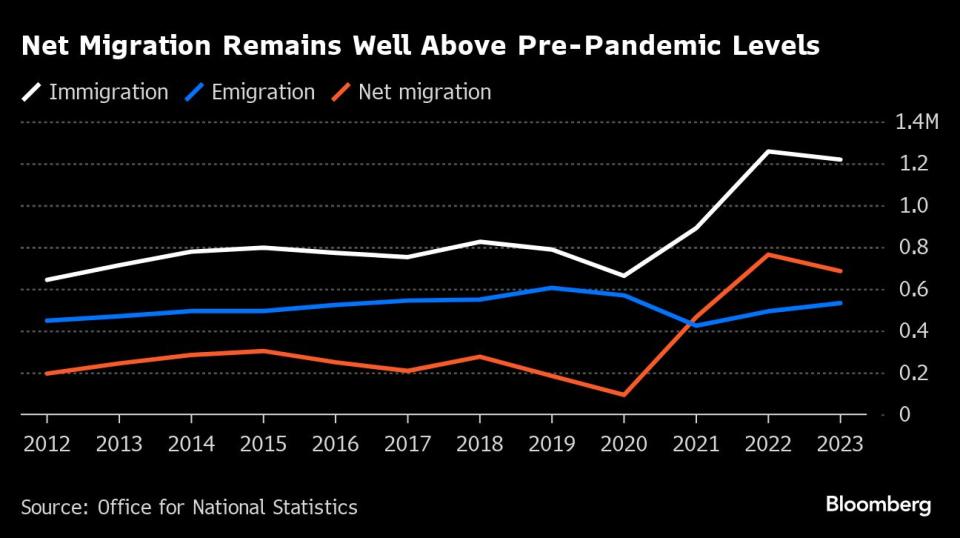

Net migration to the UK fell to 685,000 last year from 764,000 a year earlier — but was still the second highest level on record. Sunak has said that if reelected he would cap migration, increase visa fees by 25% and remove student discounts on the health surcharge. Labour, for its part, pledged in its election manifesto to bring net numbers down because the UK economy “has become overly dependent on workers from abroad to fill skills shortages.”

Nevertheless, both major parties have announced skills strategies to train up Britons to tackle the shortage. Labour plans to link up skills and immigration strategy to ensure “training in England accounts for the overall needs of the labor market.”

A Conservative spokesperson conceded the party’s policies had made it harder for companies to bring in skilled workers. Both the Tory spokesperson and a Labour party spokesperson said that their parties would encourage businesses to resort to recruiting talent domestically. While in the longer term that may bear fruit, it doesn’t solve the present needs of industry.

“We don’t have time to wait for this talent to be educated,” said Chris Reichhelm, founder of executive search firm Deep Tech Leaders said. He’s advising expanding businesses to relocate, and said one high-profile client is looking to open in the US in a move reminiscent of British chip designer Arm Holdings Ltd.’s decision last year to list on the Nasdaq rather than in London.

“We really are shooting ourselves in the foot with this attitude to talent,” said Rupert Baines, CEO of QPT, which produces chips for more efficient electric motors. “In this industry where talent really, really matters, making things more difficult than they need to be is incredibly painful and counterproductive.”

--With assistance from Jamie Nimmo and Mark Bergen.

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

Independence Without Accountability: The Fed’s Great Inflation Fail

©2024 Bloomberg L.P.

Yahoo News

Yahoo News