Imagine Holding Hudson Technologies (NASDAQ:HDSN) Shares While The Price Zoomed 335% Higher

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When you buy and hold the right company, the returns can make a huge difference to both you and your family. In the case of Hudson Technologies, Inc. (NASDAQ:HDSN), the share price is up an incredible 335% in the last year alone. On top of that, the share price is up 69% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. In contrast, the longer term returns are negative, since the share price is 83% lower than it was three years ago.

See our latest analysis for Hudson Technologies

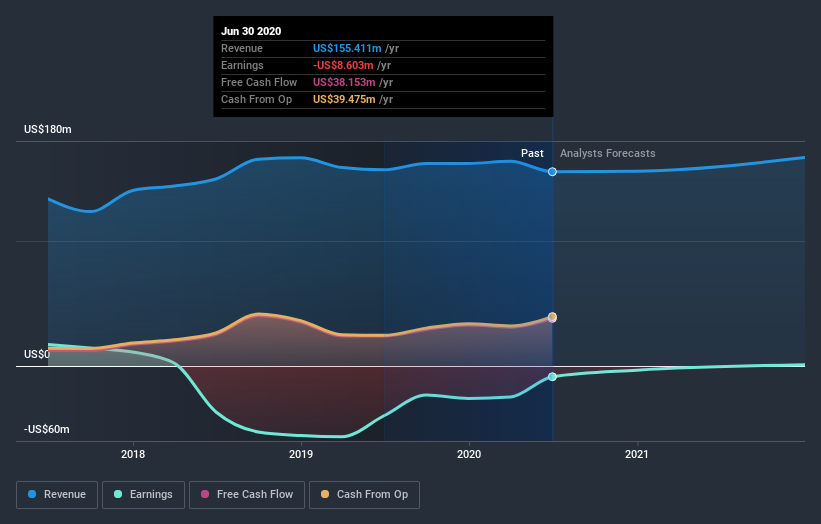

Because Hudson Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Hudson Technologies saw its revenue shrink by 1.0%. This is in stark contrast to the splendorous stock price, which has rocketed 335% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Hudson Technologies stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Hudson Technologies has rewarded shareholders with a total shareholder return of 335% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 8.8% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Hudson Technologies has 3 warning signs we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News