Low Fuel Costs Aid American Airlines Amid Travel Demand Drop

We recently issued an updated report on American Airlines Group Inc. AAL Factors like low fuel prices and focus on cargo flights are encouraging. However, dwindling air travel demand amid coronavirus-related issues are major challenges.

With dwindling passenger revenues due to the pandemic, the carrier's focus on operating cargo-only flights is a positive and should boost its top line. Notably, American Airlines is operating two cargo-only flights from the United States to Germany. Also, its decision to apply for $12-billion government aid is a positive. Through this decision, the carrier ensured to protect its employees’ jobs and payroll through Sep 30.

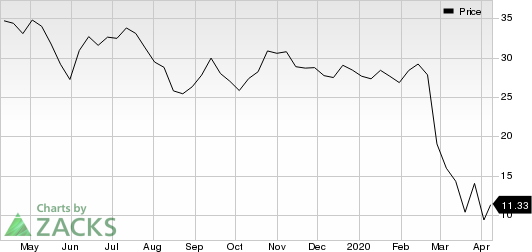

American Airlines Group Inc. Price

American Airlines Group Inc. price | American Airlines Group Inc. Quote

Additionally, the current scenario of low fuel costs is a positive for the company. Evidently, average fuel cost per gallon (scheduled) declined 8.7% to $2.05 in the December-end quarter. With oil prices falling constantly, fuel cost per gallon is expected to decline further.

However, sharp drop in air-travel demand is hurting passenger revenues, which comprise majority of its top line. Consequently, its near-term results are likely to be severely dented due to the coronavirus-induced tepid air-travel demand. Also, the carrier plans to lower April capacity by 70-75%. Its May schedule will be slashed by 80%. The carrier is reducing international flights by nearly 90% on a combined basis for the months of April and May.

American Airlines will now operate only 13 daily flights from New York's JFK and LaGuardia airports and New Jersey's Newark airport between Apr 9 and May 6. This is a massive reduction from the April 2019 average of 271 daily flights across all three airports

Zacks Rank and Stocks to Consider

Currently, American Airlines carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Transportation sector are GATX Corporation GATX, Teekay Tankers Ltd. TNK and Höegh LNG Partners LP HMLP. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Long-term (three to five years) expected earnings per share growth rate for GATX, Teekay Tankers and Höegh LNG is pegged at 15%, 3% and 8.5%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Hoegh LNG Partners LP (HMLP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News