Martin Lewis expert explains 'misunderstood' inheritance tax unique gifting exemption

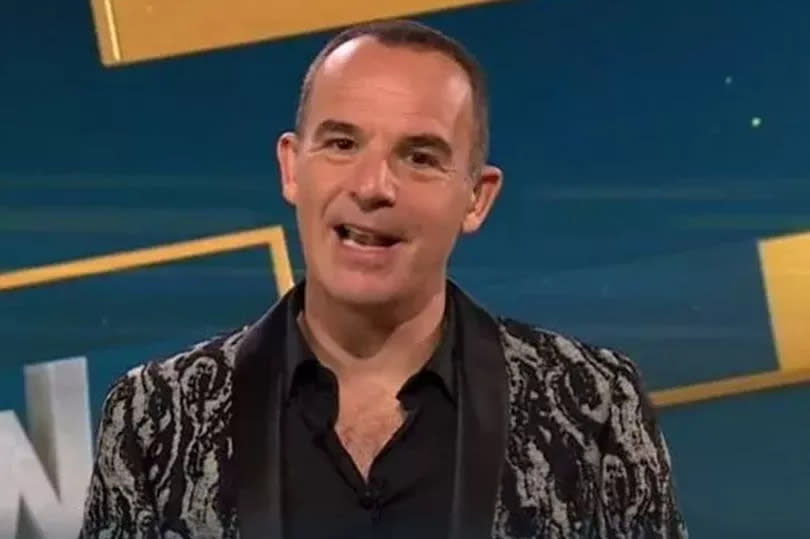

Brits wanting to pass on as much inheritance to their loved ones could be missing out on a key way to legally maximise their legacy, an expert has told personal finance guru Martin Lewis. Speaking to Mr Lewis on the Not The Martin Lewis Podcast, expert Carrie Bellan shared one unique gifting exemption for inheritance tax that many often misunderstand.

The chartered tax advisor explained that the annual gift exemption is £3,000, allowing a person to gift that maximum per donor not recipient. She emphasised this difference explaining: “I’ve seen clients think they can give £3,000 to as many people as they want.

“No, it’s if I was making a gift to you Martin, it’s me giving you £3,000 or splitting it between everyone here it would £1,000 each.” She added referencing the three finance experts in the recording booth. Carrie also explained that Brits who want to utilise this exemption but didn’t make any gifts in the last tax year can bring forward their allowance providing them £6,000 for this tax year.

The tax expert revealed a lesser-known gifting exemption as Martin questioned: “You can also give money from income can’t you?” Carrie hesitantly agreed, explaining the caveats in this exemption: “You can, provided you give regular gifts from your surplus income which do not affect your standard of living. Those gifts are immediately free from inheritance tax.”

To calculate what counts as surplus income, Carrie explained listeners must “take in all of the income you receive in one year” and minus all of their expenses including pricey one-off purchases like buying a car or going on holiday. She shared: “If you have a surplus leftover then that’s the maximum you can give away.”

Martin chimed in, seemingly bringing up a point of contention between the experts as he slammed: “So that’s for the wealthy? Once you’ve taken away all those other things most people are not going to have substantial surplus income.” Carrie admitted the people she sees use this exemption are “typically” wealthy but highlighted that anyone who does this has to ensure it’s seen as a pattern on their financial statements.

She added: “I like to say to clients you need to make the gift at least each year but my preference is to make it more frequent than that so you can show a real pattern to your gifting intentions. There was a case where someone died after making only one or two gifts of surplus income but the executors were able to prove the intention was there to make it a very regular pattern so they were successful in their claim.”

Carrie also advised people to review their finances every year in case their surplus income amount changes, noting that HMRC have “a very simple one page form where you put in your expenses and it will identify it for you”.

Yahoo News

Yahoo News