Ministers lose half a million pounds over sale of flats with Grenfell-style cladding

Ministers have lost almost half a million pounds on the sale of just 36 flats affected by the cladding crisis, The Telegraph can disclose.

Official figures obtained by this newspaper show that the Government lost £476,410 as a result of the drop in value of three dozen homes constructed with Grenfell-style cladding.

The properties were purchased using taxpayer loans under the Help to Buy scheme.

Conservative MPs said the loss to the taxpayer should act as a "wake up call" to Michael Gove, the new Housing Secretary.

Sir Peter Bottomley, the former Conservative minister, said the figures highlighted the plight of hundreds of thousands of leaseholders whose flats plummeted in value following the discovery that the properties were built with unsafe materials.

Mr Gove is facing calls to provide billions of pounds in additional funding to remediate high rise buildings affected by dangerous cladding, insulation and balcony decking, as leaseholders are faced with bills of up to six-figures for the work.

Help to Buy was created in 2013 to help boost the numbers of homes being built in the UK.

Under the scheme, buyers can purchase new-build homes costing up to £600,000 with a cash deposit of only 5 per cent.

Buyers can borrow 20 per cent of the deposit from the government, or 40 per cent if they are purchasing a property in London.

The amount paid back to the Government depends on the market value of each property at the time of the repayment.

Homes England, the government agency which administers the scheme, lost an average of £13,200 on each of the 36 homes clad with unsafe Aluminium Composite Material (ACM), according to a response to a Freedom of Information request by this newspaper.

Sir Peter, who has been campaigning for the Government to do more to address the cladding crisis said: "This should be a wake up call for the Government. For every pound that taxpayers have lost, how much have leaseholders lost?

"It is a big signpost to say, look at the vulnerable, look at the suffering.

"Hedge funds and others who have got plenty of cash and can wait for the long term can put up with it until the Government sorts it out, but lots of people in desperation are going to sell up."

According to the FOI response, another 135 loans were paid back in cases in which "the amount received was equal to or more than the amount of the equity loan originally lent."

Homes England gained £1 million from those 125 properties, an average of just £7,490 on each home.

Rocketing fire safety costs are forcing leaseholders to accept discounts of up to £200,000 on their homes from cash buyers.

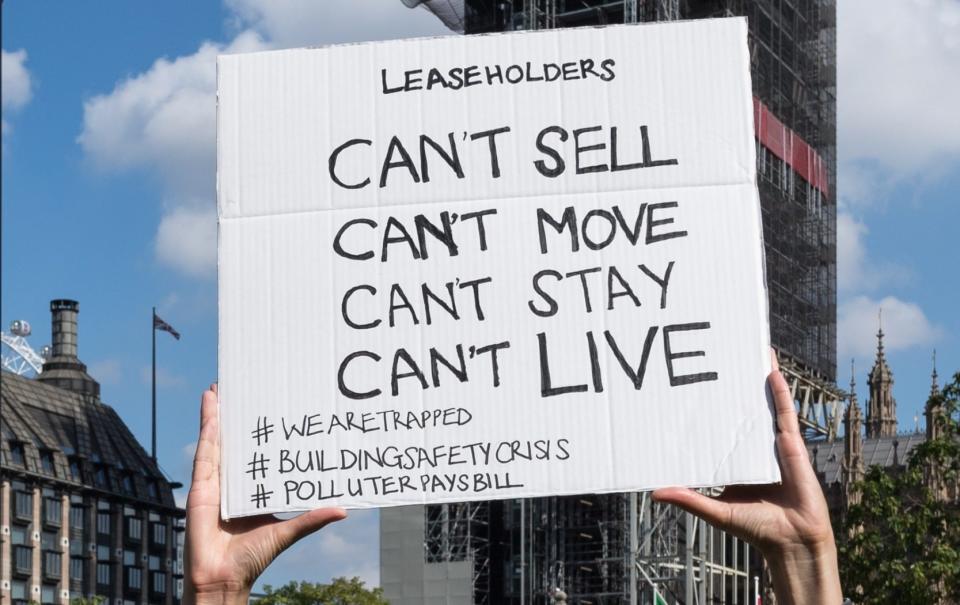

Hundreds of thousands of flat owners are effectively stuck with their properties because they are unable to sell on the open market while dangerous material remains on their buildings.

Instead, some are selling to cash buyers at significant discounts, rather than waiting for the remediation work and an EWS1 safety check, which is required by lenders to provide a mortgage on high rise flats.

Inspections in the wake of the 2017 Grenfell fire revealed endemic problems with both cladding and wider fire safety defects in flats.

The estimated cost of remediation per property is between £40,000 and £50,000.

Campaigners, backed by several Tory MPs, want the Government to significantly increase its £5 billion funding pot for the remediation of unsafe cladding on high-rise buildings, and to provide funding for the replacement of other non-compliant materials such as combustible balcony decking.

In July, the Government announced that the new Building Safety Bill would extend to 15 years the current six-year period in which legal claims can be brought against developers, amid growing concerns over homeowners having to pay vast sums to remediate poor or non-compliant work.

A government spokesman said: "We must make sure everyone is safe in their homes.

"Our £5 billion investment to remove unsafe cladding strikes the right balance between protecting leaseholders and being fair to taxpayers, supporting those in the highest risk buildings based on specialist advice and helping to restore confidence in the housing market."

Yahoo News

Yahoo News