Pre-roll ads for Periscope (TWTR)

BI Intelligence

This story was delivered to BI Intelligence "Digital Media Briefing" subscribers. To learn more and subscribe, please click here.

Twitter announced that its live streaming video service, Periscope, will now start selling pre-roll ads to an expanded network of publishers and streamers, according to ReCode.

While the new ad unit will be welcome for Periscope’s content creators, it will likely be loathed by its users, who will have to wait until an ad has played before the video is displayed.

Twitter is banking on live video to revitalize its struggling ad business, but at what cost? Here are a few advantages of in-feeds ads over pre-roll ones:

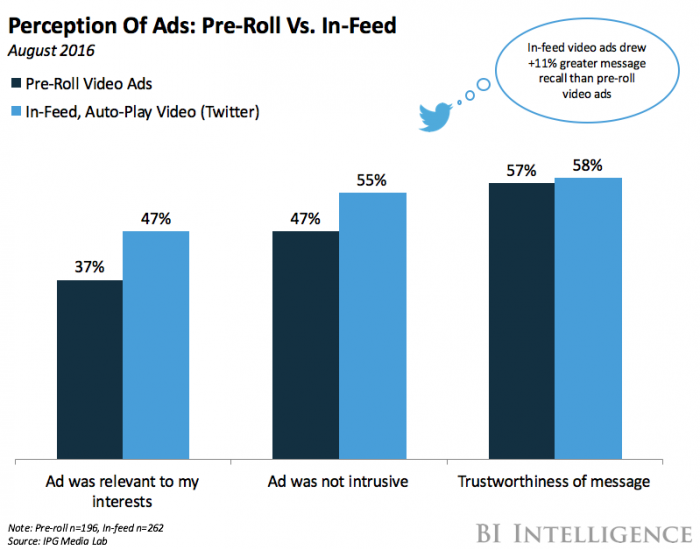

In-feed video ads are more relevant and less intrusive. Video ads on Twitter were seen as 10% more relevant and 8% less intrusive than skippable pre-roll ads, according to an IPG report. However, the trustworthiness of the message was rated as essentially the same for both ad types.

In-feed video tops pre-roll in overall recall. Thirty-one percent of respondents were able to recall the ad message of the in-feed video ads, compared to only 20% for the skippable pre-roll video ads. It's worth noting that, on average, respondents spent a full two seconds longer on skippable pre-roll ads (7.9 seconds) than in-feed ads (5.9 seconds).

Twitter has announced a number of ad product enhancement in the past few months, especially in regards to video. However, the company’s main challenge is to grow their stagnate user base, and introducing new ads could be a counterproductive initiative.

There's no question that consumers are increasing the amount of time they spend consuming digital media, while advertisers are increasing their ad budgets into digital channels. What may come as a surprise, however, is the complexity of the interconnected web of companies involved in the process of delivering digital advertisements to end users. Collectively, these companies are known as “advertising technology,” or “ad tech” for short.

Ad tech companies are intermediaries between advertisers and publishers, and add value to the ad delivery process by consolidating inventory, automating workflows, and offering precise targeting capabilities at scale. The automation of ad buying is also known as “programmatic advertising” — that is, using technology and software to buy digital ads. Programmatic ad spend in the US is quickly ramping up: It will top $20 billion this year and reach $38.5 billion by year-end 2020.

But ad tech's ascendancy isn’t without its drawbacks. The advertising industry in the US is dominated by two main players: Facebook and Google. As a result, ad tech players are fighting for a pretty small piece of revenue pie, one of the many drivers of increased consolidation in the space.

Kevin Gallagher, research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on ad tech that examines the different players involved in the process of delivering ads, the formats that are driving growth (notably mobile and video), and the factors that are driving increased consolidation over the coming years.

Here are some key points from the report:

By 2020, mobile will be the biggest online advertising market, and video the fastest growing.

So-called "walled gardens" Google and Facebook lead a relatively small group of players that attract the vast majority of digital-ad spending in the US today.

Growth can be challenging for players outside the walled-garden duopoly, and many companies are reaching a level of maturity that may prompt investors to push for an exit.

Ad tech is poised for consolidation, and the number of companies in the industry will decline significantly over the next few years.

Companies specializing in certain ad formats like mobile, video, and TV are attractive targets. They are well positioned to take advantage of the fastest growing segments of digital media.

In full, the report:

Forecasts US programmatic revenue through 2020.

Highlights the factors driving consolidation, and identifies new acquirers and attractive targets.

Explores the challenges ad tech companies face including the dominance of walled gardens, ad blocking and measurement.

Outlines emerging technologies that will help propel ad growth in the next decade.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store.» BUY THE REPORT

See Also:

Yahoo News

Yahoo News