Is Provident Financial Holdings, Inc. (NASDAQ:PROV) A Smart Choice For Dividend Investors?

Could Provident Financial Holdings, Inc. (NASDAQ:PROV) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

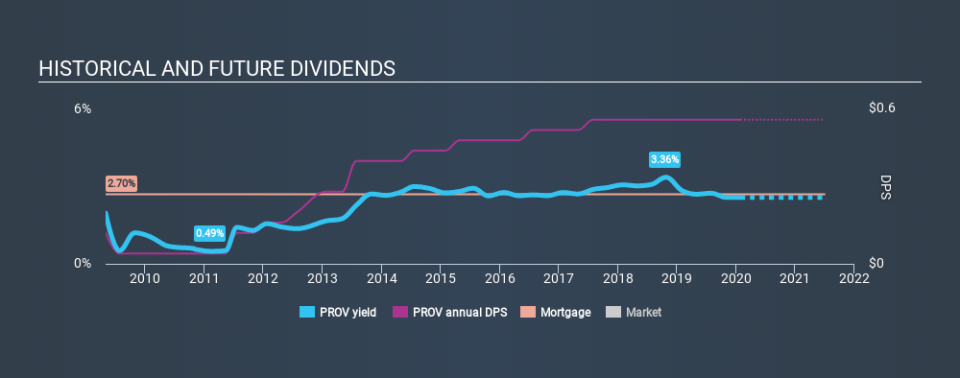

A slim 2.6% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, Provident Financial Holdings could have potential. The company also bought back stock during the year, equivalent to approximately 0.6% of the company's market capitalisation at the time. Some simple research can reduce the risk of buying Provident Financial Holdings for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Provident Financial Holdings paid out 81% of its profit as dividends. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

Remember, you can always get a snapshot of Provident Financial Holdings's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Provident Financial Holdings has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut on at least one occasion historically. During the past ten-year period, the first annual payment was US$0.12 in 2010, compared to US$0.56 last year. This works out to be a compound annual growth rate (CAGR) of approximately 17% a year over that time. Provident Financial Holdings's dividend payments have fluctuated, so it hasn't grown 17% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. While there may be fluctuations in the past , Provident Financial Holdings's earnings per share have basically not grown from where they were five years ago. Flat earnings per share are acceptable for a time, but over the long term, the purchasing power of the company's dividends could be eroded by inflation. Provident Financial Holdings's earnings per share have barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we think Provident Financial Holdings has an acceptable payout ratio. Second, earnings have been essentially flat, and its history of dividend payments is chequered - having cut its dividend at least once in the past. Provident Financial Holdings might not be a bad business, but it doesn't show all of the characteristics we look for in a dividend stock.

See if management have their own wealth at stake, by checking insider shareholdings in Provident Financial Holdings stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News