Rising Costs to Hurt Texas Capital's Profits: Time to Sell?

Texas Capital Bancshares, Inc.’s TCBI persistently rising expenses in order to hire experienced bankers will likely impede bottom-line expansion. Further, the company faces credit risks in case of any economic downturn. The deterioration in credit quality is another concern.

The Zacks Consensus Estimate for current-year earnings has moved 50.3% downward over the past 30 days. It currently carries a Zacks Rank #5 (Strong Sell).

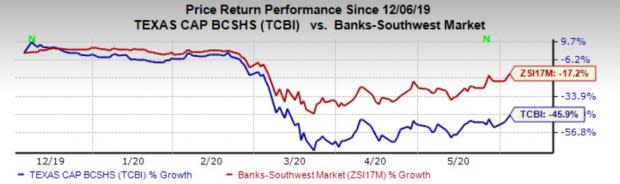

Shares of Texas Capital have lost 45.9% compared with the industry’s decline of 17.2% over the past six months.

The company’s expenses remain elevated due to its efforts to hire experienced bankers and expand its presence. Such initiatives seem encouraging in the long run but in the near term, these may lead to higher costs. It witnessed a CAGR of 15.9% over the last five years (2015-2019), with the increasing trend continuing in first-quarter 2020.

Moreover, Texas Capital’s provisions and total non-performing assets increased in 2019, indicating a deterioration in credit quality. This might increase its risk profile and it makes us apprehensive about its performance amid a challenging global economy and competitive markets.

Further, as of Mar 31, 2020, the company held a debt level of $5.6 billion and debt-capital ratio of 0.65 (above the industry’s average of 23.22), which has witnessed volatility in the past few quarters. Therefore, with a declining time-interest-earned ratio of 5, which indicates its ability to meet its debt obligations based on current income, we believe Texas Capital carries a higher credit risk, and an enhanced likelihood of default of interest and debt repayments if the economic situation worsens.

Also, the company’s business is concentrated geographically in Texas, with management’s focus being limited on the diversification as compared to some of its peers. We anticipate that lack of diversifying efforts to potentially hamper its top- and bottom-line growth in the future.

Stocks to Consider

ESSA Bancorp, Inc. ESSA witnessed upward earnings estimate revision for 2020 over the past 60 days. Its shares have lost 15.9% over the past six months. At present, it carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TFS Financial Corporation TFSL has witnessed upward earnings estimate revision for the ongoing year in the past 60 days. This Zacks #1 Ranked stock has lost 18.3% over the past six months.

Prospect Capital Corporation PSEC witnessed upward earnings estimate revision for the current year over the past 30 days. Its shares have lost 16.7% over the past six months. At present, it carries a Zacks Rank of 1.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Capital Bancshares, Inc. (TCBI) : Free Stock Analysis Report

TFS Financial Corporation (TFSL) : Free Stock Analysis Report

Prospect Capital Corporation (PSEC) : Free Stock Analysis Report

ESSA Bancorp, Inc. (ESSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo News

Yahoo News