Coronavirus: Claims deadly virus is ‘good for bitcoin’ may be confused

It is not even February and it feels like more news has happened since the start of 2020 than the whole of 2019 combined. The beginning of the new decade has seen Donald Trump play World War Three Chicken with Iran, Australia catch on fire amid dire climate forecasts, a US presidential impeachment trial, plagues of locusts devastate vast regions of Africa, and now the outbreak of a deadly virus from China.

For some cryptocurrency analysts and enthusiasts, moments of global crisis and geopolitical turmoil have become an opportunity to explain the notoriously volatile price of bitcoin.

The phenomenon has even inspired a popular meme, whereby a negative or seemingly unconnected event is arbitrarily attributed to the value of the cryptocurrency.

The 'This is good for bitcoin' theory states that during times of uncertainty, investors look to non-sovereign assets and currencies in order to safeguard their wealth.

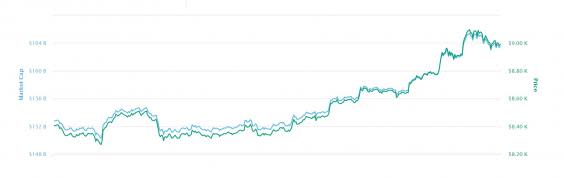

For those that adhere to the belief that bitcoin is a safe-haven asset, it therefore may seem like no coincidence that its price has performed exceptionally well throughout the chaos of 2020, increasing its value by nearly a third since the start of the year.

Now, its price appears to be climbing in direct correlation with increasing fears over the global coronavirus epidemic.

Bitcoin has risen in price every day since Wuhan was placed under quarantine on 23 January, gaining nearly 10 per cent in value in less than a week. At around $9,000, it is currently trading at its highest level since November.

Other cryptocurrencies have also followed suit, with ethereum (ether), ripple (XRP) and bitcoin cash all experiencing considerable gains since the start of the outbreak.

"Prices jumped to near three-month highs following turbulence on traditional stock markets, reinforcing cryptocurrency's growing position as a possible safe haven investment," said Simon Peters, an analysts at the online trading platform eToro.

"Cryptocurrencies seem to be mimicking the reaction seen in gold, the classic safe haven, which has also soared in recent days due to fears that the coronavirus is now spreading globally."

Similar conclusions were made earlier in January amid growing tensions between the US and Iran, as well as in August during the escalating trade war between the US and China.

Despite this, there is little research to actually support the theory that such events are related to bitcoin's fortunes. Market movements have instead been connected to developments within the cryptocurrency industry, such as favourable regulation being introduced, or rumours that a country is developing its own cryptocurrency.

Its value has also been pinned to the whims of traders who own large volumes of bitcoin, known as whales.

Cryptocurrency author David Gerard claims the cryptocurrency market is "rife with insider trading" and that a number of whales "have colluded for years" in order to manipulate its price.

"The bitcoin price is a game for whales to wreck the smaller players," he wrote in a 2019 blog post.

"Anyone who claims the bitcoin price is in any way organic, or follows real-world events, is simply talking nonsense."

Yahoo News

Yahoo News