Why everyone suddenly got religion about electric cars

This year, the automotive world had a collective come-to-God moment around electric vehicles.

Major auto players from all corners of the industry announced their plans to replace internal combustion engines with all-electric and hybrid systems, laying the groundwork for a world filled with battery-powered cars and the lower vehicle emission levels that come with them.

The shift away from gasoline didn't just come from some predetermined edict sent from an auto-deity on high. There were several factors that brought all of these disparate actors together to embrace electrification en masse this year.

SEE ALSO: Here are all the companies besides Tesla that are building trucks of the future

Not only has the industry dug itself into a hole by relying on fossil fuels for so long, but flashy new upstarts have pushed the traditional giants to innovate and switch up their strategy.

To understand exactly why automakers got religion about EVs in 2017, it's essential to examine the forces that brought the industry to the point it's at today.

The Tesla effect

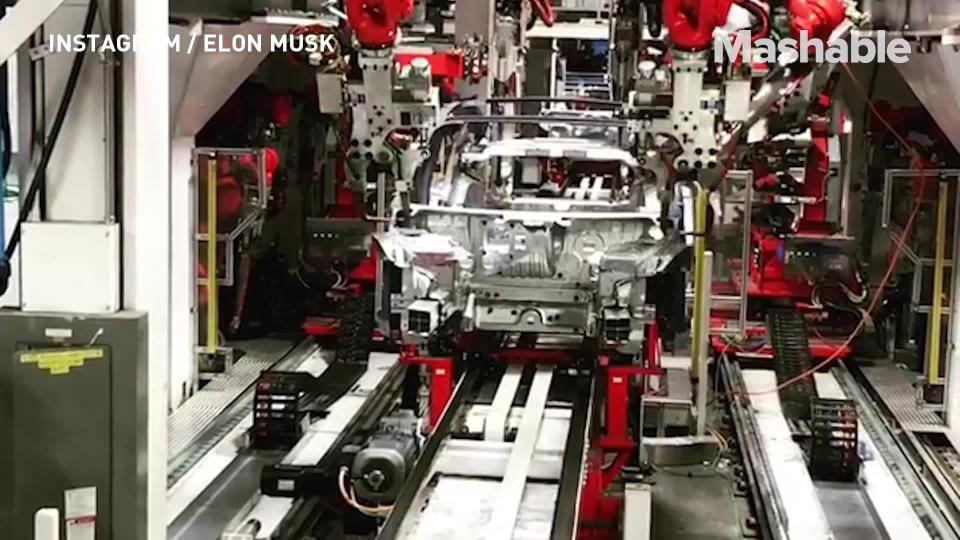

Image: tesla

The biggest automotive story of the year didn't come from one of Detroit's Big Three, Germany's giants, or Japan's juggernauts. The release of the Model 3 from relative newcomer Tesla garnered the most attention in 2017, straddling the auto and tech worlds to achieve hype unmatched by nearly any other brand outside of Cupertino. Elon Musk's all-electric automaker finally brought its (relatively) affordable $35,000 sedan to market, complete with an aggressive production plan to truly compete with bigger industry stalwarts.

The Model 3's rollout hasn't been smooth, as Musk's "production hell" has spiraled beyond even his dour projections. The Model 3 and Tesla represent an important idea, nonetheless: people can and will be convinced to buy EVs. That notion had an impact in a more intangible sense, according to Gartner Research Director Michael Ramsey.

"I think Tesla deserves a lot of credit for changing the thought process around what it takes to make electric vehicles successful," said Ramsey in a call with Mashable. He believes the automaker's success caused ripple effects on both sides of the industry: many larger entities announced their electrification strategies to the public in the second half of the year around the Model 3 release, while startups created in Tesla's image like Lucid and Fisker have come on strong to prove that smaller operations can be successful.

Tesla's biggest challenger this year was the best proof that the industry is ready to make big moves with EVs. The Chevy Bolt, another affordable EV, came into its own this year (the car was technically released in 2016, but the wider rollout happened in 2017), and actually outsold all of Tesla's models domestically in October. The total number of EVs sold this year in the U.S. is still small — just 20,750 from Tesla and 17,083 Bolts, compared to monthly sales of around 50,000 vehicles for something like a Chevy Silverado — but the needle is moving in the right direction.

New standards and emissions woes

Climate and emissions concerns also brought the adoption of electric systems to the forefront this year.

The governments of some of the biggest automotive markets around the world announced their plans to embrace electric vehicles to take dramatic steps to curb emissions. France and the UK will look to ban the sale of gas and diesel-powered vehicles by 2040.

China, the largest auto market in the world, publicly started charting a plan for an all-out ban on vehicles powered by combustion engines. The country has also doubled down on EVs and the infrastructure to support them, as the government mulls easing regulations on foreign manufacturers and announced plans to build a national network of charging points.

The continuing fallout from the Dieselgate scandal also helped to spur the embrace of electric systems to replace the tarnished diesel market. "The scandal essentially put a stake in Europe's future with diesel," Ramsey said. "The cheating was combined with the growing understanding that you can only make diesel clean to a certain point."

Ramsey thinks the sobering emissions targets, looming potential gas bans, and the need for a new narrative all swept together to bring the auto industry to a collective pivot point to focus on electrification. EV systems could play a part in providing some solutions to these challenges, or at least give automakers another chance to retain their position in a changing world.

Charging forward

While 2017 was a huge moment for electric vehicles, it's just the start.

EVs won't be truly common without major advancements in charging infrastructure and battery production, and the common auto consumer still needs to be convinced that they won't get stuck on the highway without a charge (and one that won't take hours to get you from Point A to Point B). But the pieces for mass adoption are moving into place.

UBS's latest global auto survey projects that one in five cars sold by 2025 will be electric, and estimates will only grow higher over time. When roads are filled with EVs and gasoline becomes a relic of the past, you'll be able to look back at 2017 as a year that pushed development into high gear.

WATCH: This is what the manufacturing of a Tesla Model 3 looks like

Yahoo News

Yahoo News