Did You Manage To Avoid RCS MediaGroup's (BIT:RCS) 46% Share Price Drop?

RCS MediaGroup S.p.A. (BIT:RCS) shareholders should be happy to see the share price up 22% in the last week. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 46% in one year, under-performing the market.

Check out our latest analysis for RCS MediaGroup

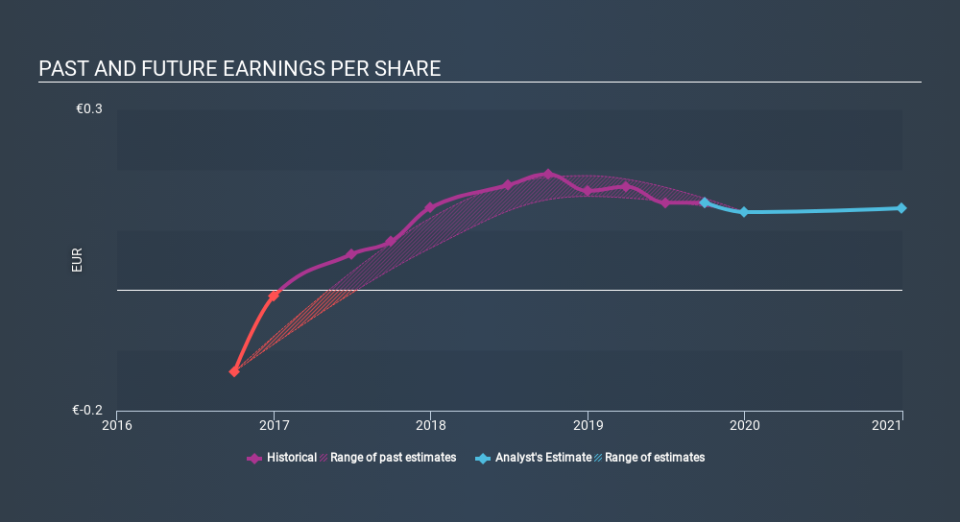

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately RCS MediaGroup reported an EPS drop of 25% for the last year. The share price decline of 46% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The P/E ratio of 4.75 also points to the negative market sentiment.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that RCS MediaGroup has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at RCS MediaGroup's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for RCS MediaGroup the TSR over the last year was -42%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 18% in the twelve months, RCS MediaGroup shareholders did even worse, losing 42% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8.4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for RCS MediaGroup that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News